D3signAllTheThings/iStock via Getty Images

Welcome to the May 2022 edition of the lithium miner news. The past month saw slightly lower lithium carbonate and hydroxide prices in China, but higher spodumene prices, including Pilbara Minerals achieving a record spodumene auction price in May of US$5,650/dmt (SC 5.5%) or ~US$6,586 /dmt (SC6.0%, CIF China basis). We also saw some positive moves from the USA and Canada to boost their EV related supply chains, notably battery manufacturing and EV metal mining.

In Q1, 2022 the lithium producers made record revenues and profits, boosted by sustained high lithium prices.

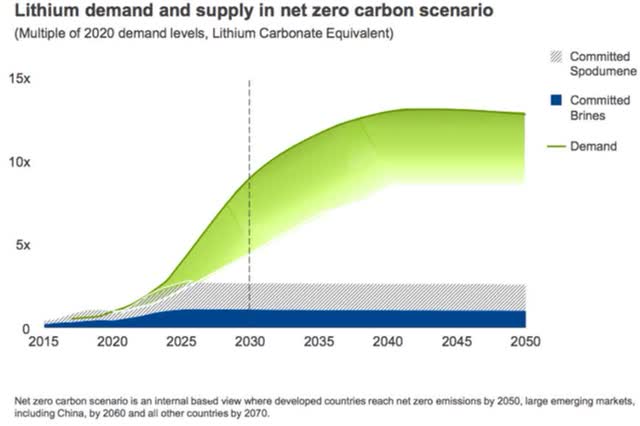

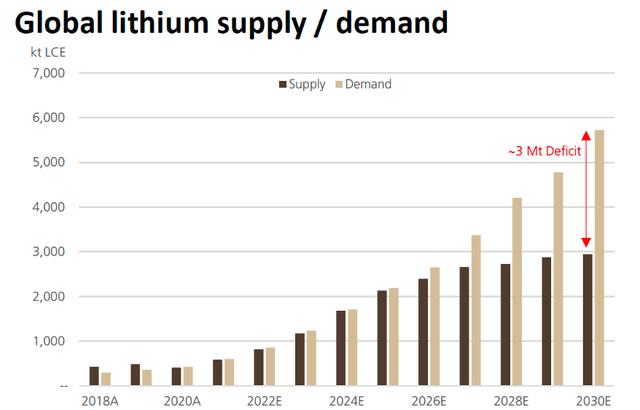

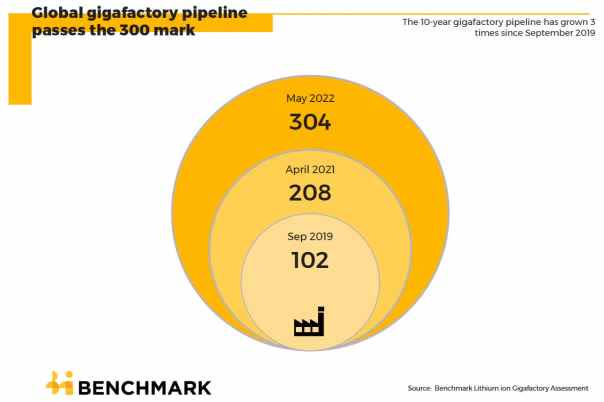

The world is beginning to understand that huge volumes of new lithium supply will be needed this decade to meet surging demand (~10x). The BMI gigafactory pipeline is now over 300 and is up 68% YoY to 6,387.6 GWh, which would require about 5.4 million tons pa of lithium (LCE) by 2030-32. 2021 lithium (LCE) demand was reported by BMI as 490,000tpa. 2020 was around 350,000tpa.

Lithium Spot And Contract Price News

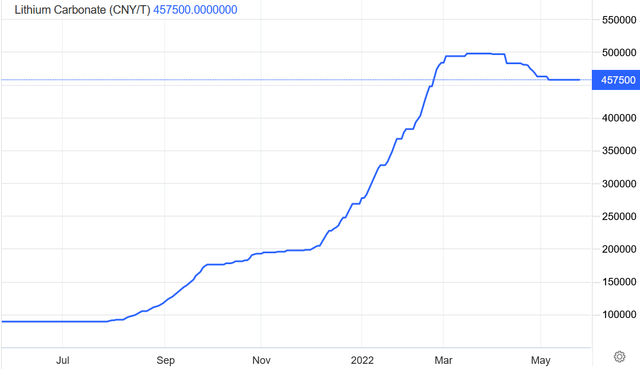

Asian Metal reported during the past 30 days, 99.5% China lithium carbonate spot prices were down 0.93% and lithium hydroxide prices were down 0.94%. Lithium Iron Phosphate (Li 3.9% min) prices were down 2.24%. Spodumene (6% min) prices were up 13.78% over the past 30 days.

Benchmark Mineral Intelligence (“BMI”) as of mid-May reported China lithium carbonate prices of RMB 462,500/tonne (US$68,450) (battery grade), and for lithium hydroxide RMB 473,000/tonne ($70,000), and stated (no link available): “Despite the temporary softening in prices, expectations are that prices will see further upside overall in H2 2022, once COVID restrictions are lifted, given that market supply remains exceptionally tight and any hindered demand from Q2 will likely be pushed into the latter half of the year.”

Metal.com reported lithium spodumene concentrate (6%, CIF China) price of CNY 31,652 (~USD 4,757/mt), as of May 24, 2022. See also Pilbara Minerals news where their BMX auctions are achieving much higher prices. The May 24 auction achieved US$5,650/dmt (SC 5.5%) or ~US$6,586 /dmt (SC6.0%, CIF China basis).

China Lithium carbonate spot price – CNY 457,500 (~USD 68,758)

Trading Economics

Lithium Demand Versus Supply Outlook

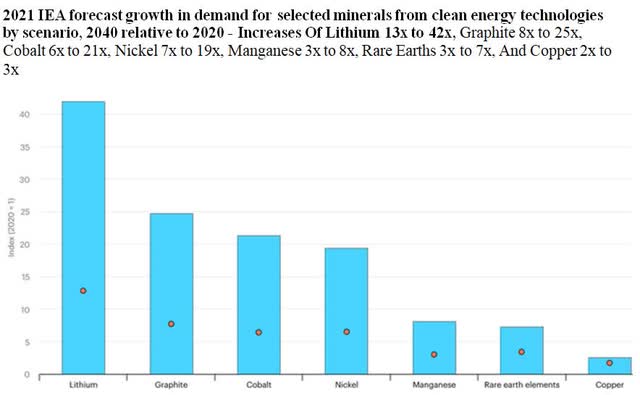

2021 IEA forecast growth in demand for selected minerals from clean energy technologies by scenario, 2040 relative to 2020 – Increases Of Lithium 13x to 42x, Graphite 8x to 25x, Cobalt 6x to 21x, Nickel 7x to 19x, Manganese 3x to 8x, Rare Earths 3x to 7x, And Copper 2x to 3x

IEA

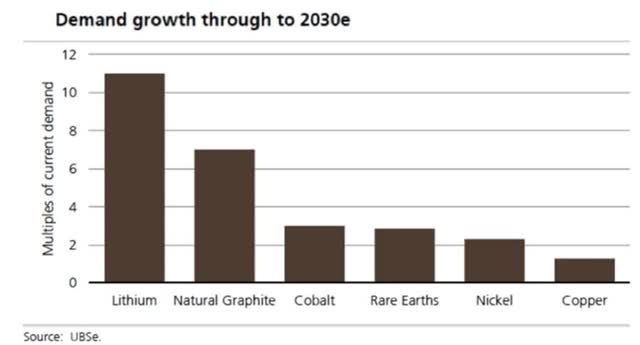

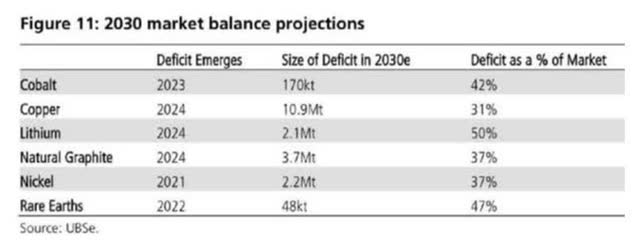

UBS’s EV metals demand forecast (from Nov. 2020)

UBS

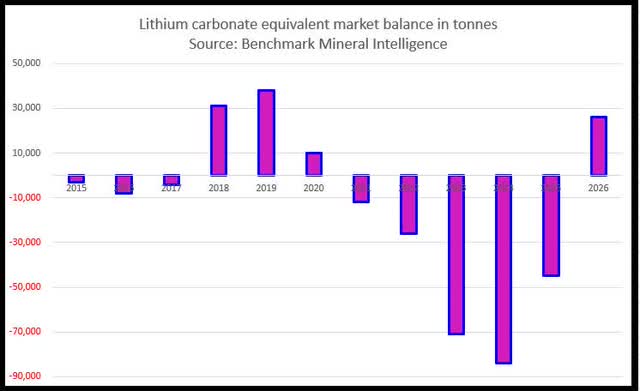

Rio Tinto’s lithium emerging supply gap chart (October 2021)

Rio Tinto

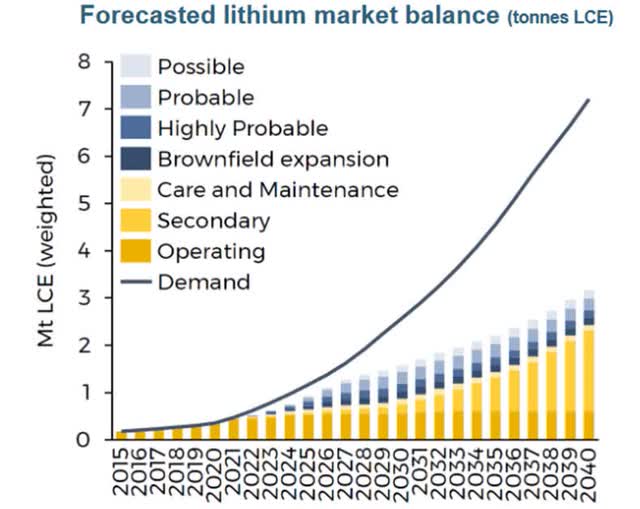

Lithium demand vs. supply forecast by Benchmark Mineral Intelligence in Q3 2021

BMI

If supply can be rapidly ramped in future years, it can come close to meeting surging demand.

BMI

UBS Forecasts Year Battery Metals Go Into Deficit (Chart from 2021)

UBS

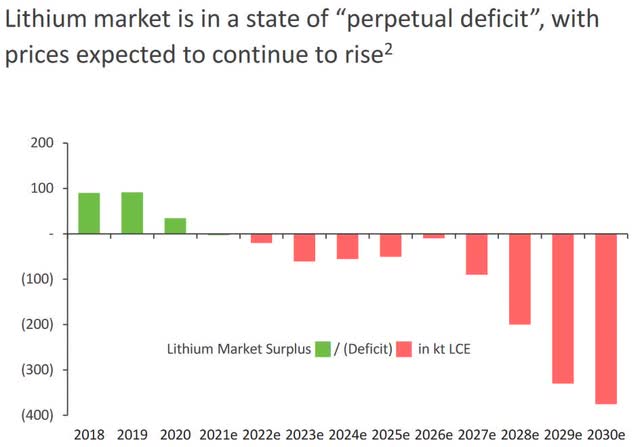

Macquarie’s lithium demand vs. supply forecast (July 2021) – Deficits from 2022 growing bigger from 2027

Macquarie

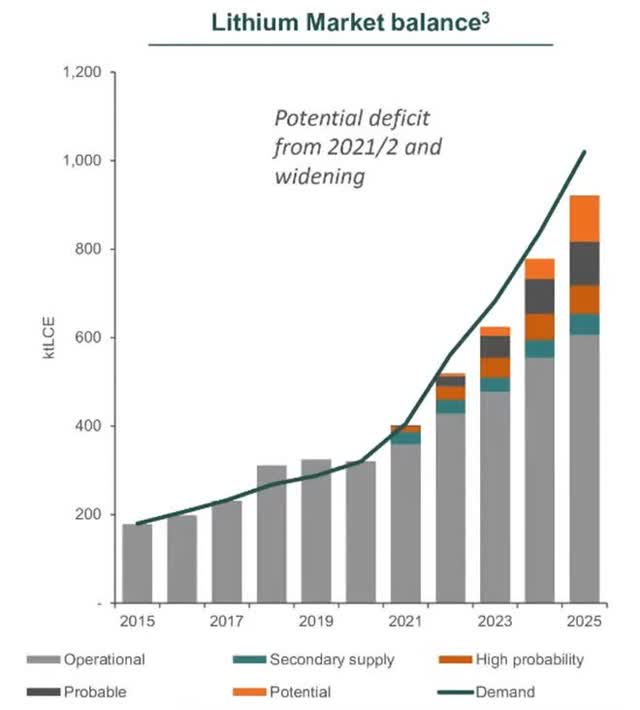

BMI 2022 lithium forecast – Deficits from 2021 to end 2025

BMI

UBS lithium demand vs. supply forecast to 2030

UBS

Lithium Market And Battery News

On April 28 Bloomberg reported:

Top bid for lithium up 140% after Musk’s ‘insane levels’ call…Pilbara Minerals Ltd.’s auction of spodumene concentrate — a partly-processed form of lithium — attracted a top bid of $5,650 a ton on Wednesday for a cargo of 5,000 tons. That compares with $2,350 at the previous sale in late October on the Australian miner’s Battery Metal Exchange. The surging prices are unnerving battery makers and EV firms. Tesla Inc. Chief Executive Officer Elon Musk said this month that lithium had gone to “insane levels” and is the “fundamental limiting factor” for EV adoption, adding the car giant might consider mining or refining it directly…“The pricing received on the BMX sales trading platform is indicative of the critical shortage that exists in respect of lithium raw material supply,” Pilbara Minerals said in a statement.

On May 3 Reuters reported:

U.S. to spend more than $3 bln on EV battery manufacturing -White House. The Biden administration will allocate more than $3 billion in infrastructure funding to finance electric vehicle (EV) battery manufacturing, U.S. officials said on Monday. The funds will be allocated by the Department of Energy from the $1 trillion infrastructure bill President Joe Biden signed last year. Among the initiatives will be processing of minerals for use in large-capacity batteries and recycling those batteries, the agency said in a statement. Biden wants half of vehicles sold in the U.S. to be electric by 2030…But the funds will not go toward developing new domestic mines to produce the lithium, nickel, cobalt and other high-demand minerals needed to make those batteries. Some of those projects face local opposition and are tied up in Biden administration environmental and legal reviews. “These resources are about battery supply chain, which includes producing, recycling critical minerals without new extraction or mining,” said Gina McCarthy, Biden’s national climate adviser…In March, Biden invoked the Cold War-era Defense Production Act to support the production and processing of those minerals. read more He requested funding to support that initiative last week as part of a $33 billion package on Ukraine-related initiatives.

On May 5 CNEVPOST reported:

CATL expects its battery capacity to reach over 670 GWh by 2025. Looking at future capacity demand and the company’s current capacity profile, it has a capacity gap of no less than 390 GWh by 2025, CATL said…plans to raise up to RMB 45 billion.

Note: Looking at CATL’s numbers, 170GWh in 2021 to 670GWh by 2025 is a 3.9x increase in just 3 years.

On May 5 Reuters reported:

Canada in ‘active discussions’ with EV supply chain companies – minister…Champagne did not name the companies, only saying he spoke to representatives of Volkswagen (VOWG_p.DE) last week, and has recently talked to executives from companies in the United States, Japan and Korea. Canada is urging critical minerals producers and processors to scale up production. It has invested in EV projects through a multi-billion dollar fund set up in 2020, and last month pledged C$3.8 billion ($3 billion) over eight years to help boost the production and processing of critical minerals used for EVs.

On May 5 Li-Cycle reported:

Li-Cycle and Glencore announce Global Strategic Partnership; Glencore to make a $200 million investment in Li-Cycle… Li-Cycle and Glencore have executed a global feedstock supply agreement under which Glencore will supply all types of manufacturing scrap and end-of-life lithium-ion batteries to Li-Cycle.

On May 8 Mining.com reported: “Metal electrolysis could support more efficient, eco-friendly processes for producing battery metals.”

On May 9 Mining Weekly reported:

Green Lithium inks deal to develop European lithium refinery using Trafigura feedstock. Lithium processing company Green Lithium has agreed terms with commodities trading company Trafigura to support the development of one of the first centralised commercial lithium refineries in Europe to supply European electric vehicle (EV) and battery manufacturers with battery-grade lithium chemicals. Under the newly-established partnership, Trafigura will supply lithium feedstock required for the planned UK-based refinery and invest equity in Green Lithium’s development phase round of funding…There is currently no commercial lithium refining capability in Europe…“This landmark project has the potential to revolutionise the European supply chain for EV production and sustainable energy storage at this critical time in the energy transition,” he adds.

On May 9 CNEVPOST reported:

Gotion High-Tech signs MOU for lithium mining in Argentina. An Argentine state-owned company will provide Gotion with prospecting and mining rights to explore a potential lithium resource of about 17,000 hectares.

On May 9 Electrek reported:

Tesla explains its approach to sourcing lithium, nickel, and cobalt directly from mines in impressive detail…The automaker says that it had directly sourced over 95% of the lithium hydroxide, 50% of the cobalt, and more than 30% of the nickel used in its high-energy density cells (NCA and NCM) in 2021. The rest came from deals between the battery cell manufacturers and their own material suppliers. As we previously reported, Tesla also released a list of the nine mining companies that are supplying those minerals.

On May 10 Simon Moores of BMI tweeted:

Big update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia and Canada You do get a feeling a new industrial trade bloc is forming for #EV – lithium-ion battery supply chain.

On May 12 Reuters reported:

Pentagon asks Congress to fund mining projects in Australia, U.K…that process strategic minerals used to make electric vehicles and weapons, calling the proposal crucial to national defense. The request to alter the Cold War-era Defense Production Act…Congress may reject or accept the proposed changes when it finalizes the bill later this year…Relying only on domestic or Canadian sources, the Pentagon said, “unnecessarily constrains” the DPA program’s ability to “ensure a robust industrial base.”

On May 11 the Korea Economic Daily reported:

POSCO to invest $20 billion in battery materials to rival Chinese firms. The investment is part of the steel giant’s long-term project to become the world’s top EV materials player by 2030.

On May 15 Bloomberg reported: “Chile copper mines dodge radical changes as convention vote ends.”

On May 15 The Guardian reported:

Chile’s constitutional assembly rejects plans to nationalise parts of mining sector. The proposal would have seen lithium and rare metal resources taken into state hands as part of the country’s wide-ranging political shakeup.

On May 17 BMW Group announced: “BMW i Ventures announces lead investment in green lithium refining technology, Mangrove Lithium.”

On May 18 CNEVPOST reported:

BYD secures $593 million worth of lithium supplies from local producer…BYD (OTCMKTS: BYDDY, HKG: 1211) will buy and commission lithium products from local lithium producer Shenzhen Chengxin Lithium Group (SHE: 002240) for an estimated 4 billion yuan ($593 million) in 2022, according to an announcement today by the NEV maker.

On May 18 AheadOfTheHeard reported: “Lithium industry needs to invest $42 billion by end of the decade to meet demand: BMI”

On May 18 CNBC reported: “EV battery costs could spike 22% by 2026 as raw material shortages drag on.”

On May 19 Benchmark Mineral Intelligence reported:

Global gigafactory pipeline hits 300; China dominates but the West gathers pace…There is now 6,387.6 gigawatt hours [GWH] of lithium-ion battery capacity in the pipeline as assessed in Benchmark’s May 2022 Gigafactory Assessment, a 68% year-on-year increase. China continues to dominate gigafactory announcements, but North America and Europe have seen significant growth over the past two years thanks in part to automaker and battery manufacturer joint ventures…

Global lithium-ion battery gigafactory pipeline – now at 304 and 6,387.6 GWh as of May 2022

BMI

On May 24 CNBC reported:

Stellantis CEO warns of EV battery shortage, followed by lack of raw materials…Tavares said he expects a shortage of EV batteries by 2024-2025, followed by a lack of raw materials for the vehicles that will slow availability and adoption of EVs by 2027-2028.

On May 25 the AFR reported:

Analysts turn more bullish on lithium after Pilbara’s record deal…It came as Citi, UBS and Barrenjoey this week issued fresh upbeat research on the lithium sector…The move highlights how the sector’s earnings upgrade cycle could have further to run as analysts continue to factor in prices lower than what miners receive, in part reflecting caution after the previous lithium boom came crashing down in 2019…Citi analyst Maximilian Layton said that although prices were likely to moderate further from “extreme” levels, they would remain “higher for longer” as global electric sales grew at a compound annual rate of 35 per cent to 2025 – from 10.7 million cars in 2022 – and supply remained in deficit until sometime next year…However, Barrenjoey’s veteran mining analyst Glyn Lawcock said the lithium market would remain in deficit through to 2030 “suggesting EV production will be limited by lithium availability, not customer demand”. Miners such as Pilbara say there is little chance of lithium prices heading back to prior lows…To put the potential imbalance in perspective, UBS’ “market-leading” forecast for lithium demand is that it will grow 10 times to 5.8 million tonnes of LCE by 2030, led by EV demand of 4.9 million tonnes as penetration soars to 54 per cent of car sales.

Lithium Miner News

Albemarle (NYSE:ALB)

On May 4 Albemarle announced: “Albemarle Reports first-quarter sales growth of 36%, raising guidance.” Highlights include:

- “Net sales of $1.13 billion, an increase of 36%; Net sales increased 44% excluding Fine Chemistry Services [FCS] business sold in June 2021.

- Net income of $253.4 million, or $2.15 per diluted share; Adjusted diluted EPS of $2.38, an increase of 116%.

- Adjusted EBITDA of $432 million, an increase of 88%; Adjusted EBITDA increased 107% excluding FCS business sold in June 2021.

- MARBL Lithium Joint Venture (MARBL) to start operation of the second train at MARBL Wodgina Lithium mine with first spodumene concentrate production expected in July 2022.

- Guidance for 2022 revised upward on increased prices in Lithium and Bromine businesses; Net sales are now expected to increase approximately 60-70% year over year and adjusted EBITDA now expected to increase approximately 100-140% year over year.”

On May 4 Seeking Alpha reported: “Albemarle +18% after easy Q1 earnings beat, powerful guidance raise.”

On May 16 ABC News reported:

Albemarle lithium processing plant just weeks from first production already looking to expand. As lithium prices surge, US chemicals company Albemarle is considering a major expansion of its refinery 200 kilometres south of Perth, with plans for a 1,000-bed capacity workers’ village. Albemarle is weeks away from first production of battery-grade lithium hydroxide at its Kemerton plant, just north of Bunbury.

On May 23, Albemarle announced:

Albemarle announces further improved full-year 2022 guidance. “Over the past 12 months, we’ve made significant progress in renegotiating more variable-priced contracts with our lithium customers. Implementation of these contracts is a key driver of the expected year-over-year improvement in our financial results,” said Albemarle CEO Kent Masters. “We now expect full-year 2022 adjusted EBITDA to be up more than 160% from prior year based on favorable market dynamics for our Lithium and Bromine businesses…Lithium adjusted EBITDA for the full year 2022 is now expected to grow approximately 300% year over year, up from previous outlook. Average realized pricing is now expected to be up approximately 140% year over year resulting from the implementation of index-referenced, variable-price contracts and increased market pricing. Full-year 2022 volume is expected to be up 20-30% year over year primarily due to new capacity coming online (unchanged from previous outlook).

Note: Seeking Alpha also reported: “Albemarle clings to gains after raising guidance for second time this month.”

Upcoming catalysts:

~June-July 2022 – 50ktpa Kemerton Lithium Hydroxide Plant converter in WA to commence battery grade lithium production (60:40 joint venture between Albemarle and Mineral Resources Limited).

May 2022 – Wodgina Lithium Mine (60% ALB: 40% MIN) Train 1 plans to restart. Train 2 to restart in July 2022. Note the recent non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV.

Sociedad Quimica y Minera S.A. (NYSE:SQM), Wesfarmers [ASX:WES] (OTCPK:WFAFY), Covalent Lithium (SQM/WES JV)

On May 18, SQM announced: “SQM reports earnings for the three months ended march 31, 2022.” Highlights include:

- “SQM reported net income for the three months ended March 31, 2022 of US$796.1 million, compared to US$68.0 million in same period of 2021.

- Revenues for the three months ended March 31, 2022, were US$2,019.8 million.

- Earnings per share totaled US$2.79 for the three months ended March 31, 2022.

- Our first quarter results include payments related to the agreement with Corfo and tax provisions that totaled approximately US$800 million.

- Adjusted EBITDA margin for the first three months of 2022 reached 58.7%.”

Upcoming catalysts:

H2 2024 – Mt Holland production to begin (SQM/Wesfarmers JV) as well as their lithium hydroxide [LiOH] refinery.

Investors can read SQM’s latest presentation here or the latest Trend Investing article on SQM here.

Jiangxi Ganfeng Lithium [SHE:002460] [HK: 1772] (OTC:GNENF) (OTCPK:GNENY)

On April 27, The South China Post reported: “Shares of Chinese lithium-salt giant Ganfeng surge as EV demand, tight supply drive nearly tenfold profit jump.” Highlights include:

- “The producer of lithium salts, used in lithium-ion batteries, posted a 955 per cent increase in net profit for the year’s first three months.

- Prices for the compounds started a mild retreat early this month after increasing fourfold since September, but Ganfeng has further room for profit growth, analysts said.”

Investors can read the latest Trend Investing article on Ganfeng Lithium here.

(Chengdu) Tianqi Lithium Industries Inc. [SHE:002466]

On May 20, Australian Mining reported:

Tianqi Lithium delivers first battery-grade product. The first batch of battery-grade lithium has been produced by Tianqi Lithium Energy Australia (TLEA) from its plant in Kwinana, Western Australia, the first time the material has been produced in Australia in commercial quantities.

Livent Corp. (LTHM)[GR:8LV]

On May 2, Livent Corp announced:

Livent announces agreement to double its ownership stake in Nemaska Lithium to 50 percent. Livent will issue 17,500,000 shares of its common stock to The Pallinghurst Group (“Pallinghurst”) and its investors to acquire their half of Québec Lithium Partners (“QLP”). Livent already owns the other half of QLP. Following the close of the transaction, QLP will become a wholly owned subsidiary of Livent, and Livent will in turn own 50% of Nemaska through QLP. Investissement Québec (“IQ”) will remain the owner of the remaining 50% interest in Nemaska.

On May 3, Livent Corp announced:

Livent releases first quarter 2022 results. Revenue was $143.5 million, up 17% from the fourth quarter of 2021 and 56% higher compared to the prior year. Reported GAAP net income was $53.2 million, 609% higher than the previous quarter, and 28 cents per diluted share. Adjusted EBITDA was $53.3 million, 94% higher than the previous quarter, and adjusted earnings per share were 21 cents per diluted share. Further improvement in lithium market conditions and strong customer demand in the first quarter supported higher realized prices than anticipated at the beginning of the year. “Strong lithium demand growth has continued in 2022,” said Paul Graves, president and chief executive officer of Livent. “Published lithium prices in all forms have increased rapidly amid very tight market conditions and Livent continues to achieve higher realized prices across its entire product portfolio…”

On May 4 Seeking Alpha reported:

Livent spikes after massive revenue guidance boost; Cowen upgrades to Buy… Citing the massive guidance hike, Cowen analysts upgraded shares to Outperform from Market Perform and raised its price target to $33 from $25, as it “significantly under-modeled contract exposure to rising prices,” and combined with increased visibility around growth – 4x at Argentina and 5x company-wide by 2025 – the firm expects an attractive growth model that is funded organically.

You can read the Trend Investing Livent article here when Livent was trading at US$7.26.

Allkem [ASX:AKE] [TSX:AKE] (OTCPK:OROCF)(formerly Orocobre)

No news for the month.

Upcoming catalysts include:

- Q3 2022 – Naraha lithium hydroxide plant (10ktpa) commissioning (ORE share is 75%).

- H2 2022 – Olaroz Stage 1 expansion commissioning followed by a 2-year ramp to 25ktpa. When combined with Stage 1 total capacity will be 42.5ktpa.

- H2 2023 – Sal De Vida Stage 1 production targeted to begin and ramp to 15ktpa. SDV Stage 2&3 combined will begin about 2025 and ramp to an additional 30ktpa. Total combined when completed will be 45ktpa.

You can read the latest investor presentation here. You can read the latest Trend Investing Allkem article here.

Pilbara Minerals [ASX:PLS] (OTC:PILBF)

On April 27 Pilbara Minerals announced:

Price of US$5,650/dmt (SC 5.5, FOB Port Hedland basis) achieved under Battery Material Exchange (“BMX”) auction conducted on 27 April 2022. Equates to an estimated price of US$6,250/dmt (SC6.0, CIF China basis).

On April 28, Pilbara Minerals announced: “March 2022 quarterly activities report.” Highlights include:

Production and Sales

- “Production of 81,431 dry metric tonnes (dmt) of spodumene concentrate (December Quarter: 83,476 dmt). Production volumes impacted by resourcing shortfalls in staff and contractors as a function of COVID-19 impacts and the tight labour market.

- Spodumene concentrate shipments of 58,383 dmt (December Quarter: 78,679 dmt), impacted by a port delay in loading a ~20,000 dmt cargo, which was scheduled for late March (departed Port Hedland on 7 April).

- Average spodumene price reference for sales in the March Quarter of US$2,650/dmt (SC 6.01, CIF China basis), in line with prior guidance (being US$2,600-3,000/dmt CIF China SC6.0 basis).

- Tantalite concentrate sales totalled 12,880 lbs (December Quarter: 29,038lbs).“

Lithium Market

- “…Strong sales price dynamic during the March Quarter, with battery grade chemical pricing suggesting another significant step-up in the offtake concentrate sales price during the June Quarter.“

Project Development

- “Pilgan Plant Improvements Project successfully commissioned, with installed production capacity now re-rated from 330ktpa to 360-380ktpa of spodumene concentrate.

- Staged restart of production from the Ngungaju Plant continued. Load commissioning of fines flotation circuit commenced on 9 April 2022.

- Scoping Study completed for Mid-Stream Project, providing preliminary support for the development and construction of a demonstration plant chemicals facility at Pilgangoora, producing value-added lithium phosphate salts via an innovative calcination and refining process.

- A Life Cycle Assessment was completed for the Pilgangoora Project identifying opportunities for decarbonisation at both Pilgangoora and within the supply chain downstream.“

Corporate

- “Operating cashflow of $113.9M delivers Quarter-end cash balance of $284.9M, inclusive of $75.2M of irrevocable bank letters of credit for shipments completed up to 31 March 2022 (December Quarter: $245M).

- Key conditions precedent and other closing criteria were progressed during the Quarter for the formation of a downstream processing JV with POSCO, with completion occurring on 13 April 2022 including the Company subscription for its 18% interest in the JV.

- Managing Director and CEO, Ken Brinsden, advised his intention to step down from the role by the end of 2022. Pilbara Minerals has commenced an executive search process for the Company’s next CEO.”

On May 17, Pilbara Minerals announced: “$20m Australian Government modern manufacturing initiative grant awarded.” Highlights include:

- “Pilbara Minerals, with its project partner Calix, has been awarded a $20 million grant from the Australian Government under the Modern Manufacturing Initiative (MMI)-Manufacturing Translation Stream, supporting the further development and demonstration of the proposed “Mid-Stream Project”.

- Grant funding will be used as part of a joint venture (Joint Venture) to be entered into between Pilbara Minerals and Calix for the progression of a demonstration scale chemicals facility at the Pilgangoora Project – with the aim of producing lithium salts for global distribution via an innovative midstream “value added” refining process…

- Pilbara Minerals and Calix are well progressed in negotiations in relation to the formation of a Joint Venture for the future development of a small-scale Demonstration Plant, with the Parties targeting to sign in early Q3 2022.“

On May 17, Pilbara Minerals announced: “Trek signs agreement with Pilbara Minerals to acquire strategic base metal exploration tenement.”

On May 24 Pilbara Minerals announced:

Results of Fifth BMX Auction. A cargo of 5,000 dmt at a target grade of ~5.5% lithia was presented for sale on the platform with delivery expected from 15 June 2022. Strong interest was received in both participation and bidding by a broad range of buyers. Pilbara Minerals intends to accept the highest bid of USD$5,955 /dmt (SC5.5, FOB Port Hedland basis) which on a pro rata basis for lithia content (inclusive of freight costs) equates to a price of approximately USD$6,586 /dmt (SC6.0, CIF China basis).

Upcoming catalysts:

Late 2023 – Plan to commission production of POSCO/Pilbara Minerals (18%) JV LiOH facility in Korea.

Mineral Resources [ASX:MIN] (OTCPK:MALRF)

Mt Marion Mine (50% MIN: 50% Ganfeng). Wodgina Lithium Mine (60% ALB: 40% MIN) plans to restart in May 2022. (Note the recent non-binding agreement will (if completes) move Wodgina to a 50% ALB: 50% MIN JV). The 50ktpa Kemerton Lithium Hydroxide refinery (60% ALB: 40% MIN) is due for first sales in H2, 2022.

On April 26, Mineral Resources announced:

Mineral Resources Limited announces proposed offering of up to US$1 billion Senior Unsecured Notes…

On May 3, Mineral Resources announced:

Mineral Resources completes US$1.25 billion Senior Unsecured Notes Offering. Mineral Resources Limited (ASX: MIN) (“MinRes”) announces that it has completed its previously announced offering of its (i) US$625 million 8.000% Senior Unsecured Notes due 2027 (the “2027 Notes”) and (ii) US$625 million 8.500% Senior Unsecured Notes due 2030…

Investors can read the latest Trend Investing article on Mineral Resources here.

AMG Advanced Metallurgical Group NV [NA:AMG] [GR:ADG] (OTCPK:AMVMF)

On May 4, AMG Advanced Metallurgical Group NV announced: “AMG Advanced Metallurgical Group N.V. reports first quarter 2022 results.” Highlights include:

- “…AMG Brazil will increase its spodumene production by 40,000 tons, bringing its production capacity to 130,000 tons per annum. The project is proceeding as planned, construction will begin in the third quarter of 2022; and commissioning will commence in the second quarter of 2023.

- AMG Lithium has started construction and will celebrate a ground-breaking ceremony at the Bitterfeld-Wolfen Chemical Park on May 11, 2022, for the first European lithium refinery, and commissioning for the first module of the battery grade lithium hydroxide upgrader will commence in the third quarter of 2023.

- AMG’s first lithium vanadium battery (“LIVA”) for industrial power management applications is proceeding as planned and commissioning has begun at AMG Graphite located in Hauzenberg, Germany.”

Financial Highlights

- “Revenue increased by 53% to $403.9 million in the first quarter of 2022 from $264.0 million in the first quarter of 2021.

- EBITDA was $54.8 million in the first quarter of 2022, 93% higher than the first quarter 2021 EBITDA of $28.3 million, marking the seventh straight quarter of sequential improvement.

- Annualized return on capital employed was 19.8% for the first three months of 2022, more than double the 9.4% for the same period in 2021.

- AMG’s liquidity as of March 31, 2022, was $478 million, with $308 million of unrestricted cash and $170 million of revolving credit availability.

- The Company has maintained its final 2021 declared dividend of €0.30 to be paid on May 12, 2022 to shareholders of record on May 10, 2022.”

You can view the latest company presentation here.

Upcoming catalysts:

2022 – Progress on lithium projects in Zeitz, Germany and in Zanesville, Ohio, both in the planning stage.

Q2 2023 – Stage 2 production at Mibra Lithium-Tantalum mine (additional 40ktpa) forecast to begin, bringing its production capacity to 130ktpa.

Q3 2023 – Lithium hydroxide facility in Bitterfeld-Wolfen Germany with production set to begin.

Lithium Americas [TSX:LAC] (LAC)

On April 28, Globe Newswire reported:

Lithium Americas announces US$10 million strategic equity investment in Green Technology Metals.

On May 5, Globe Newswire reported: “Lithium Americas reports first quarter 2022 results.” Highlights include:

Argentina

Caucharí-Olaroz

- “Construction is advancing with mechanical completion and commencement of commissioning targeted for the second half of 2022.

- Additional resources continue to be added to accelerate and de-risk commissioning and ramp-up.

- 1,650 workers are on site with activities carried out as normal.

- 100% of the workforce have received at least two doses of a COVID-19 vaccine.

- In early April 2022, the site achieved a milestone of 5,000,000 total person hours without a lost time injury.

- As of March 31, 2021, 82%, or $605 million, of the $741 million capital budget has been spent.

- Progress on the second stage expansion of 20,000 tonnes per annum (“tpa”) of lithium carbonate equivalent (“LCE”) continues to advance with additions to the technical leadership team and a drilling program underway.”

Pastos Grandes

- “On January 25, 2022, the Company completed the acquisition of Millennial and the 100% owned Pastos Grandes project for total consideration of approximately $360 million.”

United States

Thacker Pass

- “On April 14, 2022, the Company submitted a formal application to the US Department of Energy for funding to be used at Thacker Pass through the Advanced Technology Vehicles Manufacturing Loan Program.

- The Company continues to advance a feasibility study for Thacker Pass with targeted capacity of 40,000 tpa LCE and incorporating a second phase expansion to reach a targeted total capacity of 80,000 tpa LCE. Results of the feasibility study are expected in the second half of 2022.

- Construction of the Lithium Technical Development Center (LiTDC) in Reno is substantially complete and commissioning has commenced. LiTDC includes integrated testing process equipment that will replicate the Thacker Pass flowsheet from raw ore to final product. It will support ongoing optimization work, provide product samples for potential customers and partners and enable process test work on new target deposits.

- In February 2022, the Nevada Department of Environmental Protection issued the final key state-level environmental permits: Water Pollution Control Permit, Class II Air Quality Operating Permit and Mine and Exploration Reclamation Permits.

- An appeal on the Record of Decision continues to advance through a US Federal Court, with a ruling expected in Q3 2022.”

Corporate

- “As at March 31, 2022, the Company had $492 million in cash and cash equivalents with an additional $75 million in available credit…

- In February 2022, the Company commenced the process to explore a separation of its US operations, through the creation of a standalone public company focused on the development of Thacker Pass.”

Upcoming catalysts:

- H2 2022 – Thacker Pass FS and early construction works planned to commence.

- H2 2022 – Cauchari-Olaroz lithium production to commence and ramp to 40ktpa. From 2025 a Stage 2 20ktpa+ expansion is planned.

- 2023 – Possible lithium clay producer from Thacker Pass Nevada (full ramp by 2026).

NB: Ganfeng Lithium (51%) and Lithium Americas (49%) own the JV company Minera Exar S.A., which owns 91.5% interest and is entitled to 100% of the production from the Cauchari-Olaroz Project. The 8.5% interest is owned by Jujuy Energia y Mineria Sociedad del Estado (“JEMSE”) (a company owned by the Government of Jujuy province).

Argosy Minerals [ASX:AGY][GR:AM1] (OTCPK:ARYMF)

Argosy has an interest in the Rincon Lithium Project in Argentina, targeting a fast-track development strategy. Argosy is now producing at a small scale and ramping to 2,000tpa lithium carbonate starting June 2022.

On April 29, Argosy Minerals announced: “Quarterly activities report – March 2022…”

“Key objectives for June 2022 quarter

- Continue construction works for the 2,000tpa high purity battery quality Li2CO3 processing plant and associated operations.

- Formalise strategic investment for 10,000tpa expansion capex funding and Li2CO3 product off-take.

- Progress resource expansion and feasibility works at Rincon, and exploration works at Tonopah Lithium Project.

- Our foremost priority is the health, safety and wellbeing of our staff, partners and community during the Covid‐19 pandemic.”

On May 2, Argosy Minerals announced: “Rincon 2,000tpa Li2CO3 operational update.” Highlights include:

- “71% of total construction works now complete – first production of battery quality Li2CO3 product targeted during next quarter.

- 2,000tpa lithium carbonate process plant development works progressing on schedule and budget.”

Investors can view the company’s latest investor presentation here, and the latest Trend Investing Argosy Minerals article here.

Core Lithium Ltd. [ASX:CXO] [GR:7CX] (OTC:CORX)(OTCPK:CXOXF)

Core 100% own the Finniss Lithium Project (Grants Resource) in Northern Territory Australia. Significantly they already have an off-take partner with China’s Yahua (large market cap, large lithium producer), who has signed a supply deal with Tesla (TSLA). The Company states they have a “high potential for additional resources from 500km2 covering 100s of pegmatites.” Fully funded and starting mining with a planned Q4 2022 production start.

On April 27, Core Lithium Ltd. announced: “Quarterly activities report for three months ended 31 March 2022.” Highlights include:

- “Reached a landmark binding Term Sheet with US electric vehicle maker Tesla.

- Advanced construction activities at the Finniss Project.

- Completed the acquisition of highly prospective Mineral Leases adjacent to Finniss.

- Reported significant drill results at BP33 and Carlton deposits.

- Announced the resignation of long-serving MD, Stephen Biggins.

- Joined the ASX300 Index.”

On May 2, Core Lithium Ltd. announced: “Award of Finniss Lithium Project crushing contract.”

On May 3, Core Lithium Ltd. announced: “BP33 receives environmental approval.” Highlights include:

- “The Northern Territory’s Minister for Environment grants environmental approval for the BP33 Underground Mine…

- Finniss mine activities are on schedule with first ore on ship expected at the end of calendar year 2022.”

On May 10, Core Lithium Ltd. announced: “Final 2021 lithium drilling assays received.” Highlights include:

- “…Mineralisation within southern extension to pegmatite at BP33 confirmed.

- Intersections outside of the current Mineral Resource at BP33, Lees and Hang Gong expected to deliver substantial extensions.

- Exciting results from new Penfolds prospect.

- Resource drilling has recommenced at BP33, with exploration drilling across the Finniss Project to follow in the coming month.”

On May 17, Core Lithium Ltd. announced: “Finniss Project development update.” Highlights include:

- “Grants Stage 1 open pit mining rate accelerating with the arrival of five new trucks to site and new excavator scheduled to arrive by the end of the month.

- DMS plant earthworks nearing completion with handover to Primero Group expected at the end of the week.

- Crushing contract awarded to CSI with mobilisation to site to start next month.

- Grant of environment approval for BP33 with the Mine Management Plan to be submitted in the coming weeks.”

Investors can read a company presentation here, or the Trend Investing article when Core Lithium was back at A$0.055 here.

Catalysts include:

- Late 2022 – Lithium spodumene production at Finniss targeted to begin.

Sigma Lithium Resources [TSXV:SGML](SGMLF) (SGML)

Sigma is developing a world class lithium hard rock deposit with exceptional mineralogy at its Grota do Cirilo Project in Brazil.

No significant news for the month.

Catalysts include:

- Late 2022 – Production targeted to begin at the Grota do Cirilo Project in Brazil and ramp to 230,000tpa spodumene.

Investors can read the latest company presentation here or the Trend Investing article here back when Sigma was trading at C$5.00.

Lithium Miner ETFs

- Global X Lithium & Battery Tech ETF (NYSEARCA:LIT) – Price = US$70.85.

The LIT fund was slightly higher in May. The current PE is 24.94. My model forecast is for lithium demand to increase 5.1-fold between end 2020 and end 2025 to ~1.8m tpa, and 10.8x this decade to reach ~3.7m tpa by end 2029 (assumes electric car market share of 32% by end 2025 and 70% by end 2029).

Note: A Nov. 2020 UBS forecast is for “lithium demand to lift 11-fold from ~400kt in 2021 through to 2030.”

LIT Fund 10-year price history

Seeking Alpha

Source: Seeking Alpha

- The Amplify Lithium & Battery Technology ETF (BATT) is currently on a PE of 20.1. It is a broad-based fund also worth considering. On their website they state: “BATT is a portfolio of companies generating significant revenue from the development, production and use of lithium battery technology, including: 1) battery storage solutions, 2) battery metals & materials, and 3) electric vehicles. BATT seeks investment results that correspond generally to the EQM Lithium & Battery Technology Index (BATTIDX).

Conclusion

May saw lithium chemicals prices only slightly lower and spodumene prices continued to rise strongly.

The lithium miners stock prices are generally lower due to the current 2022 bear market/correction, but arguably should be rising due to their strengthening fundamentals. One example might be Pilbara Minerals on a 2023 PE of 4.6. Other examples of surging fundamentals could be ALB, SQM (profits up 11.7x YoY), Livent (profits up 609% QoQ), or even Ganfeng’s recently announced nearly 10-fold profit jump.

Highlights for the month were:

- Top bid of $5,650/t for lithium SC5.5% (US$6,250/t SC6%) up 140% after Musk’s ‘insane levels’ call…record high pricing is indicative of the critical shortage that exists in respect of lithium raw material supply.

- CATL’s expects their battery production capacity to go from 170GWh in 2021 to 670GWh by 2025, a 3.9x increase in just 3 years.

- Canada in ‘active discussions’ with EV supply chain companies – minister.

- Li-Cycle and Glencore announce Global Strategic Partnership; Glencore to make a $200 million investment in Li-Cycle.

- Gotion High-Tech signs MOU for lithium mining in Argentina.

- Green Lithium inks deal to develop European (UK-based) lithium refinery using Trafigura feedstock.

- Update to Defense Production Act: US now expands definition of “domestic source” of battery raw materials to include UK, Australia and Canada.

- POSCO to invest $20 billion in battery materials to rival Chinese firms.

- Chile’s constitutional assembly rejects plans to nationalise parts of mining sector.

-

BMI: Lithium industry needs to invest $42 billion by end of the decade to meet demand.

-

CNBC: EV battery costs could spike 22% by 2026 as raw material shortages drag on.

- BMI global gigafactory pipeline at 304. There is now a 6,387.6 GWh pipeline of battery capacity.

- Stellantis CEO warns of EV battery shortage, followed by lack of raw materials.

- Analysts turn more bullish on lithium after Pilbara’s record deal.

- Albemarle raises guidance twice in the past month due to stronger lithium price sales being achieved. Albemarle lithium processing plant just weeks from first production already looking to expand.

- SQM reported net income for the three months ended March 31, 2022 of US$796.1m, compared to US$68.0m in same period of 2021.

- Ganfeng surges as EV demand, tight supply drive nearly tenfold profit jump.

- Tianqi Lithium delivers first battery-grade product from its plant in Kwinana, Western Australia.

- Livent spikes after massive revenue guidance boost, doubles its ownership stake in Nemaska Lithium to 50%.

- Pilbara Minerals achieves record spodumene auction price in May of US$5,650/dmt (SC 5.5%) or ~US$6,586 /dmt (SC6.0, CIF China basis).

- Argosy Minerals Rincon Project 71% of total construction works now complete – first production of battery quality Li2CO3 product targeted during next quarter.

- Core Lithium on schedule for late 2022 spodumene production start. Drilling outside of the current Resource at BP33, Lees and Hang Gong expected to deliver substantial extensions. Exciting results from new Penfolds prospect.

As usual, all comments are welcome.